“Forensic accountants inhabit a cloak and dagger corner of the accounting world.”

– Justin Pope

![]()

Forensic accountants are the experts who know how to solve crimes by crunching numbers.

You’ve heard that “money is the root of all evil.” It’s no surprise to anyone that when companies and individuals hold large assets, sooner or later, someone will try to find a way to cheat their way to income that’s not rightfully theirs. Whether that’s deceit on the part of a company, client or employee, and whether it’s stolen in one big chunk or slowly funneled off, financial crimes are serious breaches of the law with major consequences.

You’ve no doubt read about high profile scandals like Enron, Worldcom, and Bernie Madoff, and know that the perpetrators behind these white collar crimes are up for hard time. But fraud also affects small businesses at an astonishing rate. In fact, the average business loses 5% of its revenue to fraud each year. According to the most recent Report to the Nations, the median loss caused by occupational fraud is $140,000; however, more than one-fifth of these cases resulted in losses of at least $1 million.

A broad survey of corporate fraud cases has found that each year, corporate fraud costs the economy $360 billion nationally and $3.7 trillion globally.

The problem with detecting and prosecuting these financial crimes is their complex and covert nature. It takes someone with an eagle eye and a nose for suspicious activity to ferret out corruption and build a case. Forensic accountants bust the financial predators who commit fraud, money laundering, embezzlement, tax cheating, and more. Today, forensic accountants are in greater demand that ever before. Computer-based accounting has made fraud easier to commit and to hide. At the same time, new legislation, like the the Sarbanes-Oxley Act, has created new and stricter corporate accounting and reporting standards. That means new opportunities in the field, and room for highly qualified forensic accountants to make a name for themselves, improve society, and take home a hefty paycheck, too.

If you want to get started in the field of forensic accounting, all you’ll really need is a bachelor’s degree to get your foot in the door. But if you want to rise to the top in forensic accounting, you’ll really need an advanced degree, like an MBA in forensic accounting. With an MBA in forensic accounting, you’ll be eligible for high-level managerial roles in the detection, prevention, and resolution of financial crimes.

If you’re exploring this in-demand degree, you’re probably wondering, “what can I do with a forensic accounting MBA?”, “How much can I earn with an MBA in forensic accounting?” or simply “What is forensic accounting all about?” Our guide to MBAs in forensic accounting will get you started with an overview of the forensic accounting field, a survey of the different degrees associated with it, the path to earning an MBA, and what you can expect out of a career with this degree. Read on to learn about how you can build an interesting and challenging career through fighting financial crimes.

What is Forensic Accounting?

Forensic Accounting has been defined as “the application of analytical and investigative skills for the purpose of resolving financial issues in a manner that meets legal standards” In plain English, that means detecting, uncovering, communicating, and proving fraud and other financial crimes by both companies and employees. Forensic accounting exists in the overlap between accounting and criminal justice.

Some of the financial crimes and other issues that forensic accounting can address include:

- Tax fraud

- Securities fraud

- Money laundering

- Calculating economic damages

- Post-acquisition disputes

- Bankruptcy, insolvency, and reorganization

- Business valuation

- Forensic Computing

What Do Forensic Accountants Do?

Forensic accountant must have expertise in accounting and in criminal justice. They use an interdisciplinary skill set which covers accounting, business, law, criminal justice, law, data technology, computer science, and data technology. Beyond detecting fraud, forensic accountants may assist legal professionals in settling contract disputes, trace concealed assets, quantify damages from professional negligence, uncover embezzlement, assist in bankruptcies, and perform business valuations. Forensic accountants also take action to prevent fraud from happening in the first place, by designing customized systems for accounting and auditing procedures.

Many forensic accountants hold a master’s or MBA in forensic accounting, though others may have only a bachelor’s degree. Most forensic accountants are also Certified Public Accountants (CPAs) or Certified Fraud Examiners (CFEs). Others have legal training that allows them to serve as expert witnesses, giving testimony by weighing in on the evidence based on their expertise in criminal and civil trails, appear in pretrial depositions, or to work with authorities to develop cases against accused white collar criminals.

How Do Forensic Accountants Work?

Just what the day-to-day work of forensic accounting looks like will vary greatly from one professional to another, and may even look quite different from one day to the next, depending on what the accountant is working on. In general, the work of forensic accounting falls into two procedure categories: Litigation Support and Investigation.

Litigation Support involves parsing out and presenting the economic issues related to a legal case, either pending or ongoing. Forensic accountants performing Litigation Support must calculate the damages incurred by both parties in a legal dispute, with the aim of resolving them before trial. If the case does escalate to a trial, they will likely be called upon to testify as an expert witness. In the practice of Litigation Support, forensic accountants must be skilled in working with legal standards, understanding courtroom standards, calculating damages, and comfortable communicating their findings to laypeople.

Investigation involves examining records and accounts to determine if criminals activity has taken place. Such crimes could include theft by employees or employers, identity theft, fraud, money laundering, or falsification of records. In civil matters, investigation may include seeking out hidden assets in a secession or divorce case.

In investigating financial crimes, forensic accountants must discover, analyze, and report. Discovery requires identifying suspicious transactions and accounts, and tracking down their source. Analysis requires the forensic accountant to determine what crime was committed and how by crunching the numbers. Reporting requires that a forensic accountant record and present their findings to authorities with clear and specific evidence.

Where Do Forensic Accountants Work?

With an MBA in forensic accounting, you’ll be investigating either civil or criminal matters, meaning that you can work for either businesses or the government. In the government, many forensic accountants work for the US Securities and Exchange Commission, or SEC, uncovering corporate fraud. Working for the SEC is a challenging environment with rewarding work, room for career growth, and excellent benefits.

Many other people with a forensic accounting MBA work for private accounting firms who consult and contract with businesses. Such accounting firms employ forensic accountants, and the largest of these, such as Deloitte, PwC, Ernst & Young, BDO International and KPMG have entire departments dedicated to forensic accounting. Smaller boutique firms also keep forensic accountant on staff. There are also many accounting firms which specialize in forensic accounting, such as RGL Forensics and Meaden & Moore. Within a firm dedicated solely to forensic accounting, you’ll have the opportunity to further specialize in the insurance, corporate, personal injury, legal, or public sector.

What is an MBA in Forensic Accounting?

An MBA in Forensic Accounting is simply an MBA with a concentration in forensic accounting. Graduate level education is becoming more and more widespread, and each year over 200,000 students in the US earn MBAs. More and more MBA programs now include the option to pursue a specialization, as students hone in on ways to stand out from the competition.

An MBA, or Master’s on Business Administration, is an interdisciplinary graduate level degree that covers advanced studies across all areas of business, including management skills, economics, leadership, and finance. With an MBA in forensic accounting, students gain a broad business skill set, along with targeted skills specific to the field of forensic accounting.

Like all MBAs, an MBA in Forensic Accounting typically takes two years to earn on a full-time basis. Accelerated MBA programs are also available that compress the coursework into shorter periods (usually 18 months). More frequently, students opt to take classes on a part-time basis while holding down a job during the day. This means spreading out the course load over a longer period, which usually extends the time to completion to 3-4 years.

Virtually all forensic accounting MBAs are designed with a curriculum which fulfills the 150 credits required by most states in order to sit for the Uniform CPA Exam. Almost all forensic accountants are also CPAs or CFEs, making this an especially important career building block for students who do not already hold one of these credentials.

What is the Difference Between an MBA in Forensic Accounting and a Master’s in Forensic Accounting?

It’s no secret that the MBA is the nation’s most popular master’s degree, thanks to its high salary and flexible, prestigious job prospects. Surveys by the Graduate Management Admission Council have found that enrollment in specialized MBAs, like those with concentrations in Finance, Accounting, or Forensic Accounting, is steadily rising. So what makes an MBA with a concentration in forensic accounting different from a master’s in forensic accounting?

Both are graduate-level degrees, both take about two years to complete, and both cover topics like advanced fraud detection, litigation, and computer forensics. The difference between the two relates to their area of focus. As U.S. News and World Report notes, an MBA is a generalist degree, even when it includes a specialization. That means the majority of your course work in an MBA program will focus on the “ins and outs” of the business world, from finance to marketing. Your forensic accounting specialization will play a supporting role in your graduate studies.

In contrast, a master’s in forensic accounting is usually offered as a Master of Science in Accounting with a concentration in forensic accounting. This degree is entirely specific to the accounting field, and will have limited (if any) business classes included as part of the curriculum. A master of Science in Forensic Accounting is more specialized, and will cover a broader range of accounting topics, like Cost Accounting, Financial Reporting, Federal Corporate Income Taxation, Corporate Financial Management, and Advanced Auditing.

What Forensic Accounting Certifications are Available?

Most forensic accountants are licensed CPAs, but there are a number of certifications offered in the field of forensic accounting that, along with your forensic accounting MBA, can allow you to stand out from other job candidates and qualify you for a range of roles in the field. Each certification has its own credentialing body, education/experience requirements, and examination standards. Forensic accounting licenses/certifications include:

- Certified Public Accountant (CPA) – American Institute of Certified Public Accountants

- Certified Forensic Accountant (CFA) – American Board of Forensic Accounting

- Certified Fraud Examiner (CFA) – Association of Certified Fraud Examiners

- Certified Internal Auditor (CIA) – Institute of Internal Auditors

If you choose to pursue a forensic accounting MBA, you’ll have a broad business knowledge, but less experience with accounting than someone with a master’s in accounting with a forensic accounting concentration. Pursuing one of the above certifications is a great way to develop your forensic accounting qualifications to put them on par with your advanced business expertise. Most MBAs in forensic accounting will prepare you for one or more of the above credentials by including in their curriculum much of the material covered by the certification exam.

What will I Study in a Forensic Accounting MBA Program?

Every school’s curriculum differs, but, in general, the course to complete this degree includes core MBA business classes, followed by forensic accounting concentration classes, along with an experiential learning component. Most MBA programs consist of about 60 credits, of which a specialization, such as a concentration in forensic accounting, makes up 9-12 credits.

MBAs are generalist degrees which turn students into business managers, administrators, and agents of change. In order to do so, they cover interdisciplinary studies in hard business skills like economics, accounting, and business law, along with soft leadership skills like communication, conflict resolution, and personnel management. Courses in these topics comprise the MBA core, a set of classes in business fundamentals which all students must complete, and which are usually delivered in a fixed sequence to build none another.

Typical courses in an MBA core include class titles like:

- Accounting

- Human Resources

- Finance

- Operations

- Marketing

- Microeconomics

- Macroeconomics

- International Business

- Management

- Leadership

Classes for the forensic accounting concentration usually take place in the MBA student’s second year, after they have mastered the basics of the business world. A concentration can consist of as few as three or as many as six classes, and some schools offer these as electives, giving students a choice as to which classes to enroll in.

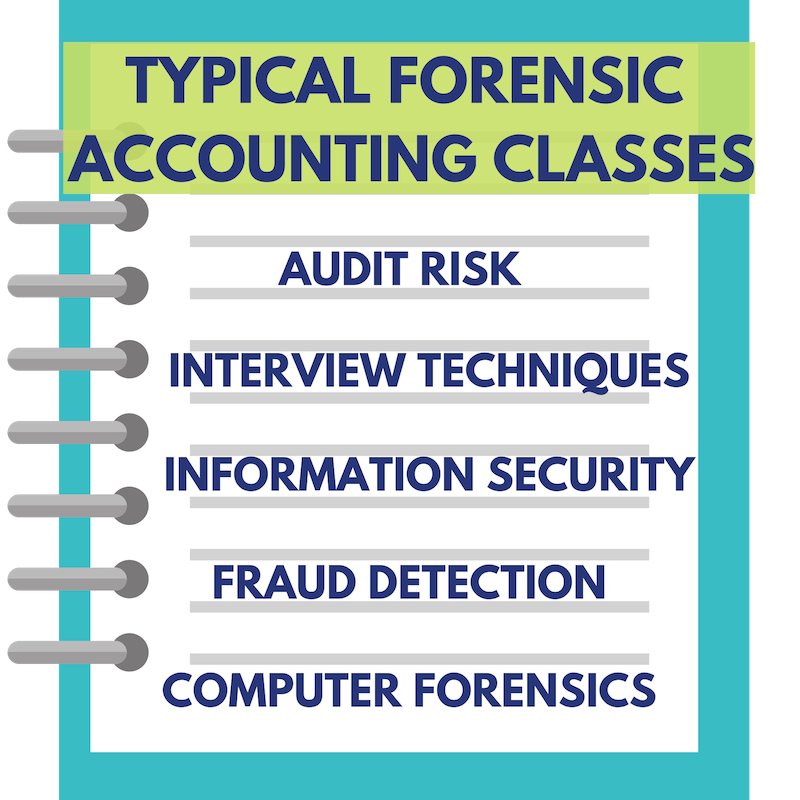

Typical courses offered in a forensic accounting concentration include class titles such as:

- Introduction to Forensic Accounting

- Audit Risk

- Business Ethics

- Legal and Regulatory Issues

- Fraud Detection and Prevention

- Interview Techniques

- Fraud Examination

- Computer Forensics

- Information Security

In addition to the MBA core and forensic accounting concentration, most MBA programs include a final project-based capstone, which synthesizes prior learning, and an experiential learning component. This usually takes the form of an internship in a business setting, but can also be a practicum or externship. In an experiential learning program, you’ll work for a real organization (usually unpaid), under close supervision from both faculty and an on-site supervisor who will provide feedback and mentoring. The purpose of the internship is to give students a chance to out their classroom learning to work in the real world and develop hands-on skills. At the end of their program, students frequently receive job offers from their internship site.

Can I Get an Online MBA in Forensic Accounting?

There are plenty of excellent Online MBA Degree programs, including quite a few outstanding

Online Forensic Accounting MBA Degree Programs. In an online MBA program, you’ll typically complete the same curriculum as in an on-campus program, including a comparable MBA core, forensic accounting concentration, capstone project or thesis, and even experiential learning.

Online forensic accounting MBA programs are ideal for those who wish to continue working while pursuing their advanced degree. Online classes can be accessed anywhere through a computer or even a mobile devise, eliminating the need to commute to classes. Online classes also typically blend on-demand course content (such as recorded lectures and posted readings) with live participatory content (such as group chats and video conferences).

This format allows busy online MBA students plenty of flexibility in scheduling, while still giving them interpersonal contact with instructors and peers. These connections are important to building a professional network, which MBA graduates cite as one of the most valuable career assets gained from their graduate degree programs. Many once programs also include some on-campus residency, such as weekend seminars or even weeklong intensives. Sometimes called hybrid programs, such on campus and online MBA programs are a good option for those looking to maximize their interpersonal connections while still enjoying a flexible class schedule.

What Jobs Can I Get with an MBA in Forensic Accounting?

An MBA qualifies graduates for a wide range of careers in business management and administration, with coursework and experiential training in leadership, accounting finance, marketing, economics, and supply chain management. An MBA with a concentration in forensic accounting combines these business fundamentals with specialized skills in fraud detection and prevention. That means, as a graduate, you’ll be especially qualified for higher-level management roles within the field of forensic accounting. You’ll also be eligible for general roles in business management, where you can apply your skills in data-driven decision making and security oversight.

Areas of responsibility open to those with an MBA in forensic accounting include:

- litigation support

- dispute resolution

- conducting research

- internal and external auditing

- examining corporate fraud

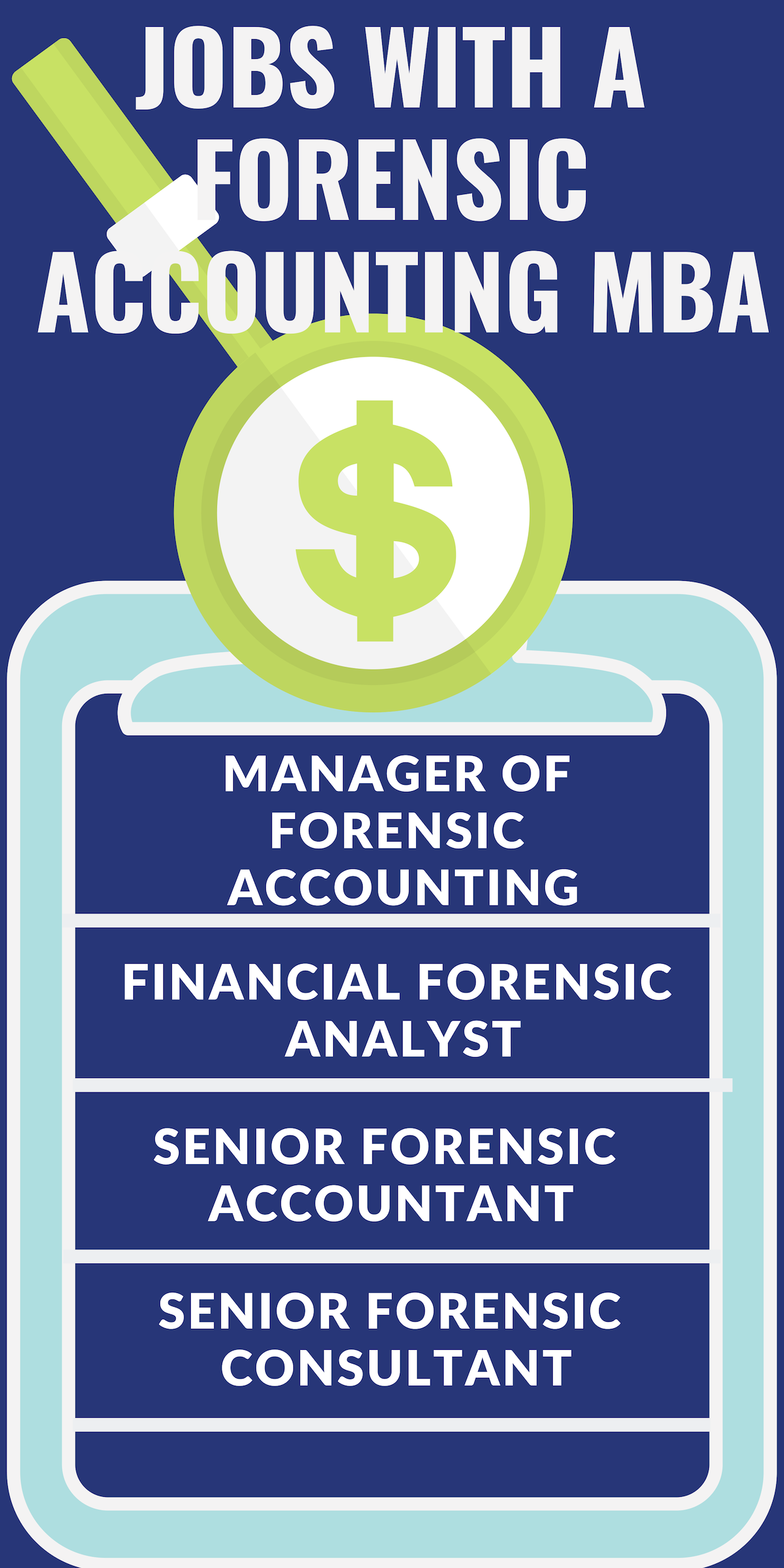

Job titles specific to the field of forensic accounting include options such as:

- Internal Auditing Manager

- Operational Risk Consultant

- Senior Forensic Accountant

- Anti-Money Laundering Specialist

- Fraud Investigator

- Manager of Forensic Accounting

- Financial Forensic Analyst

- Senior Forensic Consultant

What is the Job Market for an MBA in Forensic Accounting?

The market for accounting in general is robust, and that’s even more true for the specialty field of forensic accounting. According to the U.S. Bureau of Labor Statistics, job openings for accountants and auditors are projected to rise 10% through 2026, a faster-than-average rate of growth. With high salaries and job security, it’s no surprise that U.S. News & World Report ranked the roles of “accountants and auditors” in three different Top Jobs lists: Best STEM jobs, Best Business Jobs, and 100 Best Jobs.

High profile scandals as Enron and Worldcom have increased the demand business oversight through the The Securities and Exchange Commission (SEC), leading to a greater need for forensic accounting. Oversight at the federal and state level means a greater need for enforcement. Technology has also made financial crimes easier to commit and to hide. That’s put forensic accounting among the fastest-growing niches in the accounting profession.

While there will be plenty of job openings for qualified forensic accountants, there will be plenty of competition for higher-level positions, such as those in management. These roles are associated with significantly more autonomy, responsibility, and salary. A graduate degree is increasingly necessary to stay competitive for their higher-level positions; the American Institute of CPAs has found that that there has been a 19% increase since 2013 in enrollment in master’s level accounting programs.

How Much Can I Earn with an MBA in Forensic Accounting?

Most advanced degrees in forensic accounting are Master of Science in Accounting programs. There are still relatively few schools offering MBAs with a concentration in forensic accounting. That makes this degree a relatively unique qualification that can make your resume stand out from the competition. It also makes it difficult to tease out a clear salary expectation. To get a better understanding of how much money you can make with a forensic accounting MBA, we’ll look at salary expectations for MBAs in general, alongside salary estimates for accountants.

A general forensic accountant makes an annual starting salary between $63,000 – $102,000, according to Robert Half Accounting and Finance. Meanwhile, a person with an MBA degree makes an annual salary between $58,000 and $168,000. This means that, with an MBA in forensic accounting, you’re likely to be qualified for jobs in the higher-paying end of the forensic accounting salary range. Data from Investopedia, backs up this conclusion, showing that a forensic accountant with advanced experience or expertise, such as an MBA in forensic accounting, can make upwards of $150,000

Is an MBA in Forensic Accounting a Good Fit for Me?

What traits make a good forensic accounting professional? To succeed in this field, you’ll need:

- Impeccable integrity

- Rigorous attention to detail

- Relentless scrutiny

- Analytical thinking

- Facility with math

- Tech and software savvy

- Excellent written and oral communication

If you have these traits, and the idea of serving the cause of justice through accounting gets you fired up, you may be an excellent fit for an MBA in forensic accounting.