![]() We live in a risk-obsessed society. The need to control for unknowns and provide predictability, for our health, our retirement, economic conditions within our hometowns, and more, permeates a large portion of our economic and public lives.

We live in a risk-obsessed society. The need to control for unknowns and provide predictability, for our health, our retirement, economic conditions within our hometowns, and more, permeates a large portion of our economic and public lives.

Moreso than ever, scientific processes have been honed — by actuaries, statisticians, managers, and policymakers — to quantify risk. And for good reason. From both an organizational and stakeholder perspective, good outcomes are often synonymous with carefully managed risk. There’s a reason why most new businesses fail. Too many unknowns and unproven aspects of an organization or sector lead to the rapid demise of most new businesses. For the right kinds of investors, however, finding the right new business can be a goldmine.

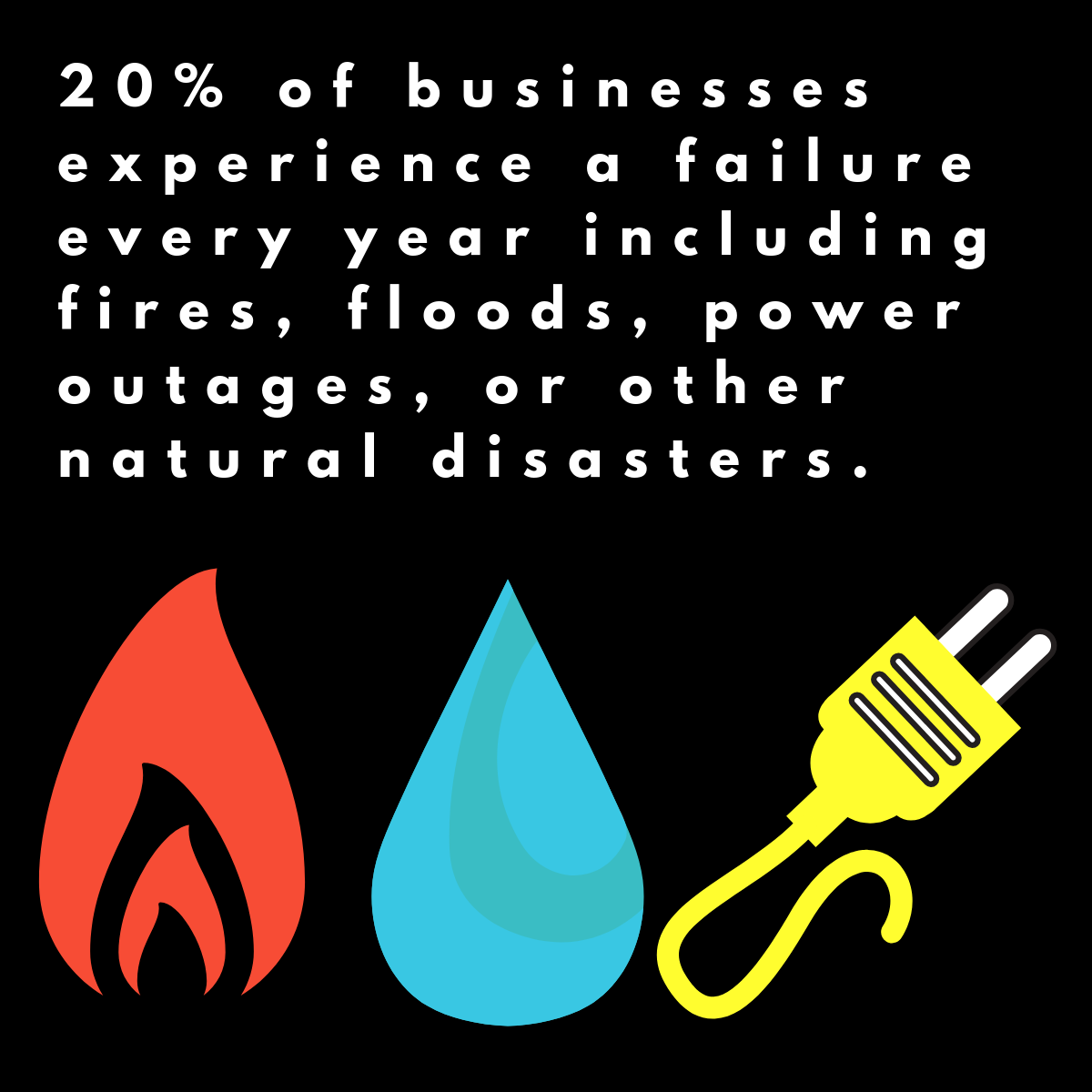

For existing businesses, it’s important to think about much more than just growth or daily operations. One in five businesses experiences a failure of some sort in any given year. This includes being the victim of crime, fires, floods, or other natural disasters, or failure of critical information technology infrastructure.

For businesses that don’t have disaster recovery plans or business continuity plans, a majority shutter their operations after a disaster.

If there was one set of tasks you could have someone perform to reverse this trend, wouldn’t you? Well, that’s where risk managers come in.

And while there are very few degrees specifically titled risk management, a wide range of masters in business administration degrees do offer concentrations in this topic.

Think you’re interested in working in the field of risk management, be sure to check out our resources related to the topic.

We’ve provided reviews of hundreds of schools on MBACentral, and a number of our rankings of academic programs relate nicely to risk management careers. Rankings include:

- The Best Online Change Management MBA Programs

- The Best Online Strategic Management MBA Programs

- The Best No-GMAT MBA Programs

- The Best Online MBA Degree Programs

If you’d like to learn more about what you can do with a risk management MBA before taking a plunge, be sure to check out the remainder of our guide below.

Table Of Contents

- What is a Risk Management MBA?

- What Other Degrees Teach Risk Management?

- Can I Get a Risk Management MBA Online?

- How do I Gain Admissions to an Risk Management MBA?

- What Can I Do With an Risk Management MBA?

What is a Risk Management MBA?

Traditional MBA require between 1 and 3 years for completion. Admissions are generally open to students with one or less years of professional experience. And they provide a wide coverage area of different business topics.

This wide coverage area is generally comprised of core courses that are similar across MBA programs.

Core courses in a traditional MBA will likely include:

- Strategy

- Economics for Business

- Statistics for Business

- Corporate Finance

- Operations or Supply Chain Management

- Global Business

- Marketing

- Analytics for Business

- Financial Accounting

- Leadership

Once students have progressed through a number of core courses within their MBA, many programs offer the ability to choose a focus area.

This focus area, of which risk management is one, is generally comprised of three to five graduate-level courses that provide more of a “deep dive” into a topic for the student.

While MBAs are first and foremost generalist degrees that can prepare students for a wide range of business roles, the focus area or concentration can help students to stand out a bit more when applying to positions within a single discipline.

While focus area courses, like electives, vary quite a bit between MBA programs, some of the most common focus area courses related to risk management may include the following:

- Derivative Securities

- Enterprise Risk Management

- Actuarial Science

- Statistics For Risk Analysis

- Interest Rate Risk Management

- Valuation

- Managing Risk

You may have noticed two distinct focal points within the above courses. And you’re right. Some programs tend to focus more on risk management from a financial position, while others tend to focus more on managing risks through business processes, leadership, and communication.

Earlier in this section, we noted “traditional” MBAs commonly have concentrations such as risk management. We make this distinction because executive MBAs often do not offer concentrations in risk management.

In fact, executive MBAs often offer no specializations. This is because executive MBAs are often more accelerated and need less courses to complete. Executive MBAs allow those with a large amount of managerial experience (5+ years) to advance quickly through an advanced degree in a wide range of business disciplines.

All this is to say, if you are looking for a risk management-heavy MBA, be sure you aren’t looking at executive MBA options.

Think you may be interested in working in the field of risk management, be sure to check out some of our resources related to the topic below.

- The Best Online Change Management MBA Programs

- The Best Online Strategic Management MBA Programs

- The Best No-GMAT MBA Programs

- The Best Online MBA Degree Programs

What Other Degrees Teach Risk Management?

As with most academic topics, there are multiple degrees that can be used to approach the same subject matter.

For risk management, there are three main graduate-level degrees. These include:

- Master of Science, Risk Management & Insurance

- Master of Finance

- And Master of Business Administration with a Risk Management Concentration

While all three can be used to gain and advance in risk management roles, they all have slightly different strengths. Below we’ll outline each in turn.

- Master of Science, Risk Management & Insurance degrees tend to focus on quantifying risk through insurance procedures. These degrees are great for those who picture themselves working in a managerial capacity with a number of statisticians or actuaries. Focal points include laws related to insurance, the insurance claim process, and quantifying risk. This degree is more focused on the disaster preparedness, response, and recovery notion of risk management, rather than the finance perspective.

- Master of Finance degrees provide a solid graduate-level background in quantifying risks in financial terms. This form of risk management degree focuses on risks posed by shifts in the glocal economy and supply chains, as well as what financial processes can be enacted to maximize values for shareholders.

- Finally, MBAs with Risk Management concentrations provide a solid graduate-level background for all types of managerial positions within organizations, with an emphasis on risk management. If you see yourself wanting to excel in risk management roles, but also potentially filling other roles in your future, MBAs are some of the most versatile graduate business degrees out there.

While the choice is up to you, MBAs are the most versatile of the three degree types above. If you’d like to advance technical or highly specialized skills related to risk management, an MS in Risk Management, Insurance, or Finance may be the route. But if you want to advance your capacity for being a good manager, leader, and risk management professional, an MBA may be the way to go.

If you think you might be interested in working in the field of risk management, be sure to check out some of our resources related to the topic below.

- The Best Online Change Management MBA Programs

- The Best Online Strategic Management MBA Programs

- The Best No-GMAT MBA Programs

- The Best Online MBA Degree Programs

Can I Get a Risk Management MBA Online?

Masters in Business Administration programs were some of the first graduate degree types to embrace distance learning and enhanced flexibility for students.

This is likely because MBA students are by-and-large non-traditional students. They hold down full-time jobs, often have family obligations, and are often a good bit older (and more advanced in their careers) than traditional university students.

This is to say that you can most certainly get a risk management MBA online.

A few terms you may want to become acquainted with while searching for an online MBA include the following:

-Asynchronous online programs allow students to “attend” class whenever they please. While these programs still have due dates for assignments and planned tests, “classes” are recorded and set up beforehand instead of being “live.” These programs afford the greatest level of flexibility. Though they can have less interaction in them than synchronous programs.

-Synchronous online programs mimic the structure of “in-person” degrees online. Students log into a portal and watch live lectures. In these lectures, they often interact with classmates and instructors through audio chat, video chat, or forums. Class times are scheduled in advance and though students may attend from wherever they please, they are expected to “show up” (digitally) on time.

-Fully online programs require no on-campus visits throughout the entirety of the program. If a program web site does not note 100% or fully online delivery, be sure to follow up with someone in admissions as many programs are hybrid.

-Hybrid online programs require some in-person meetups for degree delivery. The frequency and amount of time required in-person can vary greatly between programs. Hybrid programs can require 1-2 meetings a year in-person, or 1-2 meetings a week in-person. So if you think you want a fully online degree, don’t automatically discount all hybrid programs. Some may just require a handful of meetups throughout the entire program.

While there are plenty of online MBA programs to choose from, students should be aware of some of the pros and cons of online education. Online education can be highly flexible, more affordable, and provide the same degree as in-person programs. But some students find there is a lower level of support and that online program delivery requires more of a self-starter mentality.

If you think you might be interested in working in the field of risk management, be sure to check out some of our resources related to the topic below.

- The Best Online Change Management MBA Programs

- The Best Online Strategic Management MBA Programs

- The Best No-GMAT MBA Programs

- The Best Online MBA Degree Programs

How do I Gain Admissions to an Risk Management MBA?

The admissions process for entering a risk management MBA program is generally identical to that of entering an MBA. The only potential difference may be seen in an additional set of questions or essays related to your chosen concentration. Most programs will allow you to apply to the general MBA program and choose a concentration at a later date, however.

The core components of an MBA application include:

- Undergraduate transcripts

- GMAT or other applicable standardized test scores

- Letters of Recommendation

- Essay questions and the general application

- A resume

- Financial arrangements for tuition and fees

Working our way down the list, undergraduate transcripts are used to determine that you have obtained a bachelor’s level degree from a regionally accredited institution. Additionally, some programs will have minimum GPA requirements. Most commonly a 3.0 GPA or above is required for admission to an MBA program. For the most competitive of programs, above a 3.5 is recommended.

GMAT results have long been the standard test for admissions to MBA program. Increasingly, fewer and fewer programs are requiring GMATs, or are additionally accepting other graduate-level standardized test results.

Letters of recommendation may be from academic or work force settings for MBA admissions purposes. These function to provide information that may not be easily sharable in other portions of the admissions process. For instance, perhaps you are highly technically skilled, work well in teams, or have leadership qualities that others can attest to. These often function as verification that you have work experience, a requirement of some programs.

Resumes are used to provide verification that you hold minimum work experience for entry into the program. Generally, most MBA programs will allow students with one or fewer years of experience entry into the program.

The general application for an MBA program is similar to that of many undergraduate programs. You will likely have to complete a series of essays as well as a statement of purpose. Just as you likely don’t wish to start on an expensive and time-consuming degree process just to need to “drop out” due to a program that isn’t a good fit, so too do business schools want to ensure that students find a program that is a good fit. This is because many programs are judged based on metrics including graduation rates, transfer rates, and so forth.

Finally, many programs wish to see that you have some arrangements in place to fund the program. While MBAs can be quite affordable, they can also be some of the most expensive graduate-level programs available. It just depends on the program you’re entering.

Some of the most common ways in which students make arrangements for financial matters in MBAs include filling out the Federal application for student financial aid (the FAFSA). As a professional graduate degree, MBA students are eligible to take out up to the entire cost of attendance in student loans. Additional routes to funding include employer benefits that cover continuing education, self-pay, or scholarships.

If you think you might be interested in working in the field of risk management, be sure to check out some of our resources related to the topic below.

- The Best Online Change Management MBA Programs

- The Best Online Strategic Management MBA Programs

- The Best No-GMAT MBA Programs

- The Best Online MBA Degree Programs

What Can I Do With an Risk Management MBA?

As we’ve mentioned above, MBAs are some of the most versatile graduate-level degrees available. More CEOs of major corporations in America hold MBAs than all other graduate degrees combined.

This means that the short answer to what you can do with a risk management MBA is “almost anything.” MBAs acquaint students well enough with a wide variety of business fields to be able to manage in each of them. While risk management MBAs will obviously help to prepare students a bit more for risk management roles, they don’t need to feel obliged to continue this career path if other opportunities present themselves. And an MBA will be there to aid in future job opportunities regardless of the role.

For students looking to become directly involved with risk management, some of the most common career pathways include:

- Audit and Assurance Supervisors

- Operational Risk Consultant

- Risk Analyst

Audit and assurance supervisors help to prepare enterprises for finance-related risks including regulatory changes and proper handling of tax law.

A typical job description for a role such as this may vary by industry. Though the following will likely apply:

- Stay up-to-date on industry and regulatory body news

- Craft and implement solutions to pending regulatory changes

- Become the educational voice for your organization about changing regulations

- Provide a solid understanding of financial instruments, their risks, and how finances may be manipulated to ensure risks are acceptable

- Craft a framework through which to chronicle and judge acceptable risk levels

- Craft reporting protocol as it relates to financial and regulatory risk

Though there are entire hierarchies within audit and assurance supervision, the two primary roles comprise an analyst level of seniority and a supervisorial level. Audit and assurance supervisor salaries may vary greatly depending on the location and field in which they work. But a nationwide average is presently $81,877.

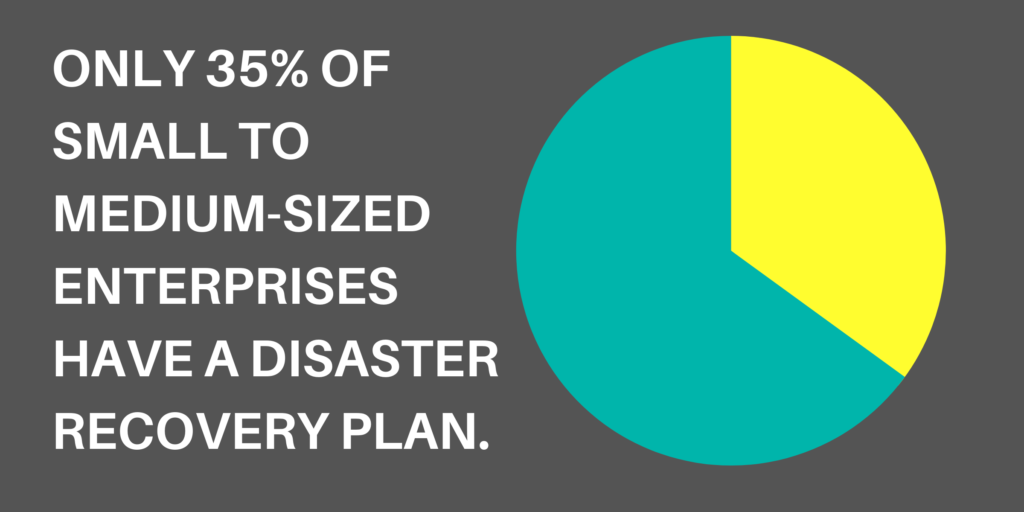

As many as 80% of small to medium enterprises have no disaster recovery or continuity plans in place. For many organizations that don’t have the budget to task an entire team on quantifying risk, the next best option is to hire a consultant. Operational Risk Consultant is potentially the most common job title within non-finance centered risk management. These consultants help to craft solutions for third-party organizations as they relate to risk.

While our first career we observed centered around risk in a financial sense, operational risk consultants also analyze risks of the physical world. These may include natural disasters, crime, or logistical issues. If you’re looking for a job that must think critically about the underlying assumptions of a business, try to find trouble with them, then implement a solution, risk consulting may be for you.

While some of the top risk management consultants make substantially more, the average salary for an operational risk consultant is currently $78,051.

Our final career that a risk management MBA can help to prepare you for is that of risk analyst. MBA graduates with no experience in the field of risk management can quickly hit the ground running in this role and get a ton of hands-on experience.

Risk analysts perform the analysis of risk that policy makers within an organization use. If you want to become acquainted quickly with how the whole process of risk management works, risk analyst positions can be a great place to start.

While there is a wide range to what risk analysts do, they are typically competent with advanced quantitative skills including statistics, understanding of legal jargon, and computer skills ranging for advanced spreadsheet knowledge to machine learning.

Risk analysts are potentially the most common risk management position, and often work in small teams under the guidance of a more experienced risk management professional.

Some of the most common industries in which risk analysts work include insurance, governmental agencies, large manufacturing firms, for policy research organizations, and for defense corporations.

The salary of risk analysts can vary greatly, as can their degree of responsibility. Some small organizations may have a single risk analyst performing all risk management-related tasks. While large organizations may have many teams filled with risk analysts.

The current average salary for risk analyst positions is $62,603.

If you think you might be interested in working in the field of risk management, be sure to check out some of our resources related to the topic below.